We are proud to announce another investment property closing!

Thomas Morgan, CCIM represented an all cash 1031 exchange buyer in the purchase of a net leased property in Winston-Salem, NC.

The $3,265,000 all cash sale closed in 29 days. The property is leased to Sleepy's on a net leased basis for 12 years. The 1031 investor exchanged from a management intensive industrial/retail property to this hands-off, long term, low risk NNN investment.

The property was a 2014 build to suit for Sleepys and has phenomenal location characteristics with high traffic counts and visibility in the dominant retail corridor.

Sleepy’s LLC is a privately owned four-generation mattress retail company founded in 1931 in Brooklyn, New York, the company currently has over 2,900 employees. Sleepy’s is the second largest specialty mattress retailer and the largest bedding retailer in the US.

The seller was represented by Pegasus Investments out of Beverly Hills, CA.

Please contact Thomas Morgan, CCIM for cap rate details or for information and availability of other triple net 1031 investments. 1-866-539-1777

Other recent closings include a remodel to suit 15 year net leased Arby's, several NNN Dollar Generals and a long term NNN 7-Eleven ground lease.

Get 1031 Exchange Property Information

Property Highlights

− Corporate lease with Sleepy’s, LLC

− Additional guaranty from HMK Mattress Holdings, LLC (parent co.)

− Brand new trophy quality construction

− High impact site plan (building built right up to the lot line fronting Hanes Mall Blvd.)

− 12 year lease term with minimal landlord responsibilities

Location Highlights

− A+ location within the heart of Winston-Salem’s Hanes Mall retail core

− Irreplaceable Sam’s Club outparcel property

− Phenomenal site lines and visibility

− Excellent access from both Hanes Mall Blvd. & Stratford Road

− Nearly 500,000 population and $64k average household income within primary trade area

− Surrounded by super regional anchors including Costco, Sam’s Club & Target

− New $20 million “The Lofts” development under construction down the road brining new population

− Shared drive aisle access with Sam’s Club, Chick-Fil-A, Verizon, Jared Jewelers, PetSmart & Gander Mtn.

Tenant Highlights

− Sleepy’s, LLC is the largest bedding retailer and the second largest mattress retailer in the United States

− Tenant current employs~2,900professionals

− Tenant has over 900 retail locations in sixteen states from Maine to North Carolina, primarily in the

Northeastern, Mid-Atlantic and the Midwest

− 10 distribution centers located throughout the country delivering over 3,000 mattresses daily

− In 2009, Sleepy’s was named the fastest-growing furniture retailer in the US

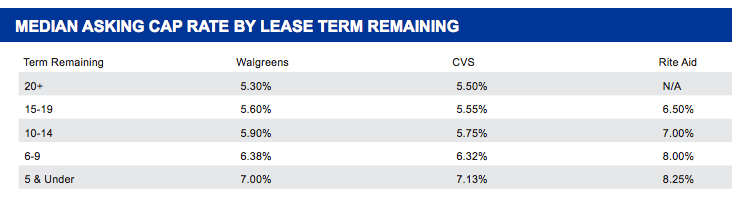

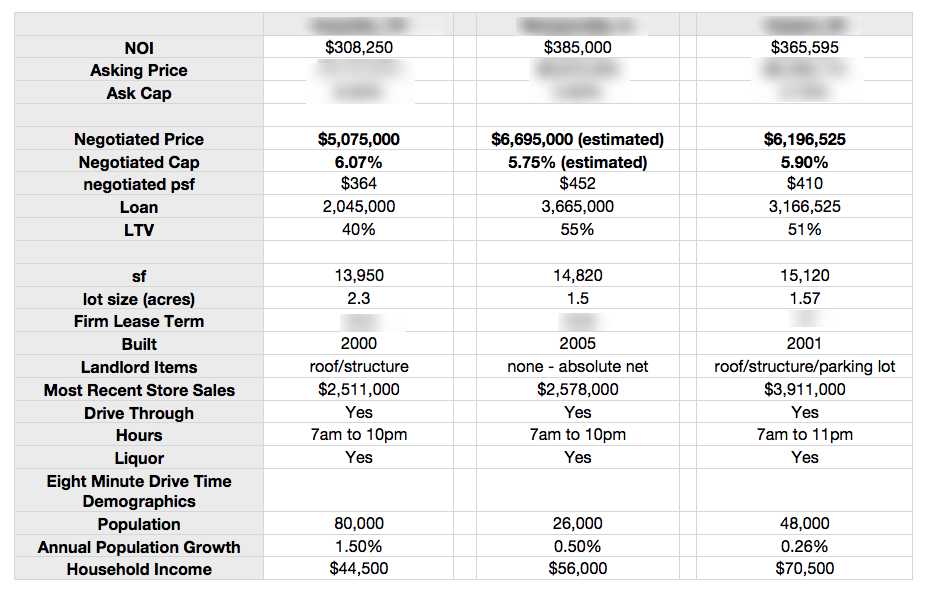

Finding a good selection of Walgreens 1031 NNN Real Estate for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the

Finding a good selection of Walgreens 1031 NNN Real Estate for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the  Under a tight 1031 timeframe Morgan evaluated several Walgreens nationally and submitted offers on multiple properties to assure successful completion of the 1031.

Under a tight 1031 timeframe Morgan evaluated several Walgreens nationally and submitted offers on multiple properties to assure successful completion of the 1031.

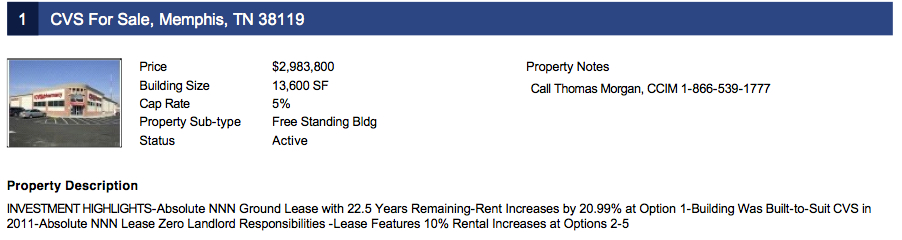

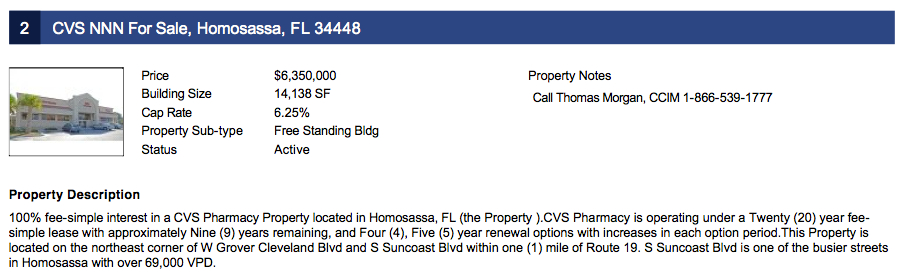

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

CVS NNN deals continue to be in hot demand. Long term net leases of 20 or more years with a solid credit rated and no landlord responsibilities.

Ground lease investment properties are some of the most unique types of NNN opportunities.

While a regular "fee simple"

Ground lease investment properties are some of the most unique types of NNN opportunities.

While a regular "fee simple"

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the

Finding a good selection of NNN properties for sale is not as easy as you might hope. Because there is no reliable central repository of commercial listings, the

I had inquired about a portfolio of

I had inquired about a portfolio of  In my eyes, at least 75% of it is BS. Yes, it could be called good salesmanship and trying to get the highest price for the seller; which is fine, he is doing is job then. However, in my experience, this is classic false urgency. It's like when I submitted an LOI on a Walgreens in Pine Bluff Arkansas in Dec 2012 and they say they have 6 offers above list price and it will close before end of 2012 all cash. Sure. It has been back to market at least three times since then and may even still be for sale today.

In my eyes, at least 75% of it is BS. Yes, it could be called good salesmanship and trying to get the highest price for the seller; which is fine, he is doing is job then. However, in my experience, this is classic false urgency. It's like when I submitted an LOI on a Walgreens in Pine Bluff Arkansas in Dec 2012 and they say they have 6 offers above list price and it will close before end of 2012 all cash. Sure. It has been back to market at least three times since then and may even still be for sale today.

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can

Other advantages NNN properties offer are significant. An investor can lock in a long-term lease with a tenant who sets up shop in NNN properties. They can