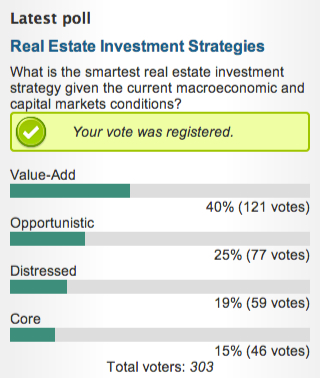

Great question posed on National Real Estate Investor online as a poll. My answer: Value-Add

Looks like I scored an "A" on this test.

What strategy are you pursuing?

Here is a quick summary of real estate investment strategies via Wikipedia:

Private equity real estate funds generally follow core-plus, value added, or opportunistic strategies when making investments.

Core Plus: This is a moderate risk/moderate return strategy. The fund will generally invest in core properties however some of these properties will require some form of enhancement or value-added element.

Value Added: This is a medium-to-high risk/medium-to-high return strategy. It will involve buying a property, improving it in some way, and selling it at an opportune time for a gain. Properties are considered value added when they exhibit management or operational problems, require physical improvement, and/or suffer from capital constraints.

Opportunistic: This is a high risk/high return strategy. The properties will require a high degree of enhancement. This strategy may also involve investments in development, raw land, and niche property sectors. Investments are tactical.