Closing costs differ around the United States.

Closing costs including title insurance are usually based on local custom where the property is located. Yes, this is negotiable but in most cases, even if the Buyer and Seller are in different states, the parties pay closing costs based on the customs and traditions in the county where the property is located.

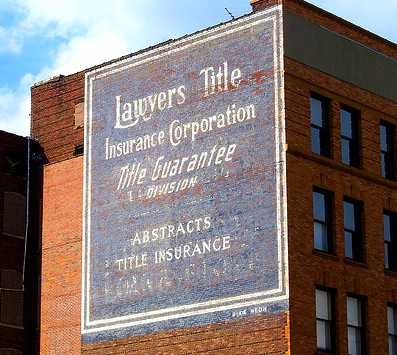

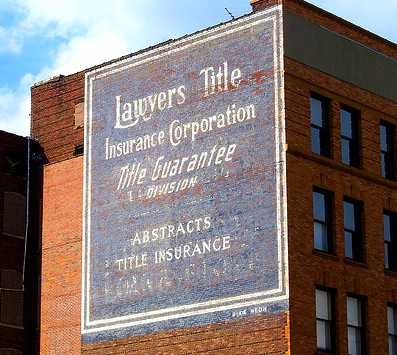

Here is a great State by State guide to real estate closing costs and who pays title insurance. Again, this differs in every transaction and is usually negotiated by the Buyer and Seller in the deal unless it is mandated by state law. The following list is via Closing costs around the United States www.miadomo.com. Photo credit Doug Francis Virgina Realtor.

Closing costs around the United States

This is a general reference guide. Contact a local title company, real estate attorney, lenders or private escrow companies who handle closing in your state for specific information.

Alabama

Buyers and sellers negotiate who's going to pay the closing costs and usually equally split them.

Alaska

Buyers and sellers negotiate who's going to pay the closing costs and usually equally split them.

Arizona

The seller customarily pays for the owner's policy, and the buyer pays for the lender's policy. They split escrow costs otherwise.

Arkansas

The seller customarily pays for the owner's policy, and the buyer pays for the lender's policy. They split escrow costs otherwise.

California

Not only do escrow procedures differ between Northern and Southern California, they also vary from county to county. Contact local title company for a specific information.

Colorado

Closing costs are generally paid by real estate agent. Sellers pay the title insurance premium and the documentary transfer tax.

Connecticut

Buyers pay for examination and title insurance, while sellers pay the documentary and conveyance taxes.

Delaware

Buyers pay closing costs and the owner's title insurance premiums. Buyers and sellers share the state transfer tax.

District of Columbia

Buyers pay closing costs, title insurance premiums, and recording taxes. Sellers pay the transfer tax.

Florida

Buyers pay the escrow and closing costs, while county custom determines who pays for the title insurance. Sellers pay the documentary tax.

Georgia

Buyers pay title insurance premiums and also closing costs usually. Sellers pay transfer taxes.

Hawaii

Buyers and sellers split escrow fees. Sellers pay the title search costs and the conveyance tax. Buyers pay title insurance premiums for the owner's and lender's policies.

Idaho

Buyers and sellers split escrow costs in general and negotiate who's going to pay the title insurance premiums.

Illinois

Buyers usually pay the closing costs and the lender's title insurance premiums and the state and county transfer taxes.

Indiana

Buyers pay closing costs and the lender's title insurance costs, while sellers pay for the owner's policy.

Iowa

Buyers and sellers share the closing costs; sellers pay the documentary taxes.

Kansas

Buyers pay the lender's policy costs and the state mortgage taxes, sellers pay for the owner's policy.

Kentucky

Sellers pay closing costs; buyers pay recording fees, responsibility for payment of title insurance premiums varies from county to county.

Louisiana

Buyers pay the title insurance and closing costs.

Maine

Buyers pay the title insurance and closing costs, buyers and sellers share the documentary transfer fees.

Maryland

Buyers pay the title insurance, closing costs and transfer taxes.

Massachusetts

Buyers pay the title insurance, closing costs, except in Worcester where sellers pay.

Michigan

Buyers pay the lenders title insurance premiums and, closing costs, and sellers pay the state transfer tax and the owner's title insurance premiums.

Minnesota

Buyers pay the lender's and owner's title insurance premiums and the mortgage tax/ Sellers pay the closing fees and the transfer taxes.

Mississippi

Buyers and sellers negotiate the payment of title insurance premiums and closing costs. There are no documentary, mortgage or transfer taxes.

Missouri

Buyers and sellers generally split the closing costs. Sellers in western Missouri usually pay for the title insurance policies, while elsewhere the buyers pay.

Montana

Buyers and sellers split the escrow and closing costs, sellers usually pay for the title insurance policies.

Nebraska

Buyers and sellers split escrow and closing costs, sellers pay the state's documentary taxes.

Nevada

Buyers pay the lender's title insurance premiums, sellers pay the owner's and the state's transfer tax.

New Hampshire

Buyers pay all closing costs and title fees except for the documentary tax, that's shared with the sellers.

New Jersey

Both buyer and seller pay the escrow and closing costs. The buyer pays the title insurance fees, and the seller pays the transfer tax.

New Mexico

Both buyer and seller pay the escrow and closing costs, sellers pay for the insurance premium.

New York

Buyers generally pay most closing costs, including all title insurance fees and mortgage taxes. Sellers pay the state and city transfer taxes.

North Carolina

Buyers and sellers negotiate the closing costs, except that buyers pay the recording costs and sellers pay the document preparation and transfer tax costs.

North Dakota

Buyers pay for the closing, the attorney's opinion, and the title insurance, sellers pay for the abstract.

Ohio

Buyers and sellers negotiate closing costs, but sellers pay the transfer taxes.

Oklahoma

Buyers and sellers share the closing costs, except that the buyer pays the lender's policy premium, the seller pays the documentary transfer tax, and the lender pays the mortgage tax.

Oregon

Buyers and sellers split escrow costs and transfer taxes, the buyer pays for the lender's title insurance policy and the seller pays for the owner's policy.

Pennsylvania

Buyers pay closing costs and title insurance fees, buyers and sellers split the transfer taxes.

Rhode Island

Buyers pay title insurance premiums and closing costs, sellers pay documentary taxes.

South Carolina

Buyers pay closing costs, title insurance premiums, and state mortgage taxes, sellers pay the transfer taxes.

South Dakota

Sellers pay the transfer taxes and split the other closing costs, fees and premiums with the buyers.

Tennessee

The payment of title insurance premiums, closing costs, mortgage taxes, and transfer taxes varies according to local practice.

Texas

Buyers and sellers negotiate closing costs.

Utah

Buyers and sellers split escrow fees, and sellers pay the title insurance premiums.

Vermont

Buyers pay recording fees, title insurance premiums, and transfer taxes.

Virginia

Buyers pay the title insurance premiums and the various taxes.

Washington

Sellers pay the title insurance premiums and the "revenue" tax, buyers and sellers split everything else.

West Virginia

Buyers pay the title insurance premiums and sellers pay the documentary taxes and the divide the other closing costs.

Wisconsin

Buyers pay closing costs and the lender's policy fees, sellers pay the owner's policy fees and the transfer taxes.

Wyoming

Buyers and sellers negotiate who's going to pay the various closing costs and title insurance fees.

To buy real estate forms, please look at MiaDomo's legal forms section or our real estate forms links.

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location. Learn more...

Walgreens NNN in CA

Price: $7,250,000

Cap Rate: 5.77%

60-Year Double Net Lease, -Rare Infill Location, -Over 650K Residents in a 5-Mile Radius, Hard Corner, Signalized Intersection, Strong Store Sales, Highly Visible Location. Learn more... Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Learn more...

Walgreens NNN in CA

Price: $11,060,000

Cap Rate: 5.75%

Learn more... Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A) Learn more...

Walgreens NNN in OK

Price: $5,650,000

Cap Rate: 6.15%

Ten (10), Five (5) year renewal options, Twenty-Five (25) year lease term with Seventeen (17) years remaining, 100% leased and guaranteed by Walgreen Co. (S&P: A) Learn more... Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location. Learn more...

Walgreens NNN in TX

Price: $7,285,000

Cap Rate: 6%

Strong National Credit, Brand new 25 year absolute NNN lease, Signalized, Hard Corner Location. Learn more... Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store. Learn more...

Walgreens NNN in KY

Price: $4,179,000

Cap Rate: 6.75%

Strong corporate Guarantee -Walgreens co., ranked #32 fortune 500 list 2012, America’s #1 Drug store. Learn more...

When purchasing a

When purchasing a

ife just because he is Tiger Woods.

ife just because he is Tiger Woods.

It was a good week at TMO Inc! TMO sold two investment properties to two separate real estate investors:

$2,455,000

It was a good week at TMO Inc! TMO sold two investment properties to two separate real estate investors:

$2,455,000